6 Types of F.I.R.E. Financial Independence Retire Early

The Financial Independence Retire Early movement (FIRE or FI/RE) has become popular in recent years, attracting people from all walks of life who are looking to take control of their finances and secure their financial future. But not everyone who is interested in FIRE approaches it in the same way. In fact, there are several different types of FIRE, each with its own unique approach and set of goals.

In this article, we will explore the different types of FIRE, including Coast Fire, Lean FIRE, Barista FIRE, Chubby FIRE, Fat FIRE and ExpatFIRE.

We will also examine the key differences between each type, as well as the pros and cons of each approach.

Whether you are just starting your journey towards financial independence, or you are looking to find the right approach for your situation, this article will provide valuable insights and information to help you achieve your goals.

So if you’re ready to take control of your finances and secure your financial future, read on to learn more about the different types of FI!

Different Types of Financial Independence

Barista FIRE

Barista FIRE is when someone has saved up a good amount of money for retirement but not quite enough to quit working forever. They usually work a part time while making small withdrawals from their retirement accounst, 1-4%. With the added component of having a part-time job or freelance work to supplement retirement income, they can let their retirement savings grow and enjoy a nice work-life balance. The goal is to reach financial independence and retire early, but with the security and stability of having a secondary source of income.

This is similar to Coast FIRE, except that someone doing Coast FIRE generally doesn’t make any withdrawals from their retirement account and fund their lifestyles with their job.

With Barista FIRE, individuals can live frugally, save a high percentage of their income, and invest in a diversified portfolio of low-cost index funds, while also earning money from part-time work or freelance opportunities. This allows for more financial stability and a higher standard of living in retirement, without sacrificing the goal of reaching financial independence as soon as possible.

Like Coast FIRE and Lean FIRE, Barista FIRE requires discipline and sacrifice, but it also allows for more flexibility and a more relaxed approach to reaching financial independence. It is a good option for individuals who want the security and stability of having a secondary source of income in retirement, while still being able to live frugally and enjoy the freedom and flexibility of early retirement.

Coast Fire

Coast FIRE refers to a stage in the FIRE journey where someone has saved and invested enough in their retirement account that they no longer need to contribute to it anymore. At this point most people cut back on how many hours they’re working, increase their spending, or both.

You should also be sure to have an emergency fund with 3-6 months of cash in it. Most people keep this in a high yield savings account for quick access in an emergency.

What makes Coast Fire so powerful, is that you have time and compounding interest working for you. If you enjoy working at your job and don’t plan on retiring for another 30 years, then you might need a lot less to retire on than you thought.

Let’s look at an example of a 35 year old that has saved up $500,000 and plans to retire at age 60.

This gives them 25 years for their money to grow which, at an average of 7% a year, comes out to about $2,700,000 by the time their 60. And this is without any further contributions to their retirement accounts, meaning that they can spend every dollar that they make at their current job, or reduce their hours to just cover their monthly expenses.

To reach Coast FIRE, you need to have saved and invested a significant amount, and have a well-diversified portfolio that is expected to generate enough returns to support their desired retirement lifestyle. This often involves saving and investing a large portion of one’s income, as well as making smart investment decisions and avoiding unnecessary risks.

Once someone reaches Coast FIRE, they have the flexibility to retire early, or continue working if they choose, without worrying about the financial stability of their retirement. It provides a sense of financial security and peace of mind, knowing that their investments are expected to provide enough income to support their desired lifestyle in retirement.

Lean FIRE

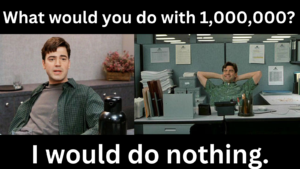

Lean FIRE is generally geared toward people who want to quit their job as soon as possible and put an emphasis on time and freedom rather than on material possessions.

Lean FIRE works by focusing on reducing expenses and living frugally in order to reach financial independence as soon as possible.

The goal is to save a high percentage of one’s income, often 50% or more, and invest in a diversified portfolio of low-cost index funds. This allows individuals to reach financial independence and retire early, even if it means living on a tight budget.

Lean FIRE proponents argue that reducing expenses and living below one’s means is key to achieving financial independence, and they often follow a minimalist lifestyle. They may opt for simple living arrangements, like living in a duplex or house hacking.

While Lean FIRE is a great way to reach financial independence quickly, it does require a significant amount of discipline and sacrifice, as individuals must be willing to make significant changes to their lifestyle and spending habits. However, for those who are committed to the Lean FIRE lifestyle, the rewards can be significant, including the ability to retire earlier, have more control over their time, and live life on their own terms.

It’s also important to remember that Lean Fire can be a starting point and once it is reached then you can still find other ways to generate income through side hustles, starting a business you’re passionate about, real estate or even getting a part-time job that you enjoy which brings us into our next type of FIRE, Barista FIRE.

Chubby FIRE

“Chubby FIRE” is a term that is sometimes used to describe a middle ground between Lean FIRE and Fat FIRE. It is a more balanced approach that combines elements of both, allowing for some discretionary spending while still focusing on saving and investing a significant portion of one’s income.

With Chubby FIRE, individuals may live frugally and avoid unnecessary expenses, but still allow themselves some luxuries and comforts. The goal is to reach financial independence as soon as possible, while still enjoying life and avoiding extreme frugality.

Chubby FIRE is a good option for individuals who want to balance saving and investing with a more enjoyable standard of living. It requires discipline and sacrifice, but also allows for more flexibility and a more relaxed approach to reaching financial independence.

FatFIRE

FatFIRE is generally for those with high incomes, successful businesses or those who are willing to wait until a little later in life to retire early.

This is because FIRE that emphasizes reaching financial independence while still maintaining a comfortable standard of living. The goal is to save and invest enough to cover a high annual spending rate while still being able to retire early.

Fat FIRE is often seen as a more relaxed approach to FIRE, as it allows individuals to enjoy a higher standard of living while still pursuing financial independence. This might include spending money on expensive hobbies, dining out, or traveling.

Individuals pursuing Fat FIRE often have high income levels and invest in a diversified portfolio of low-cost index funds, real estate, or other assets. They may also have additional sources of passive income, such as rental properties, that can provide a steady stream of income in retirement.

While Fat FIRE requires a significant amount of saving and investing, it also allows for a more enjoyable and fulfilling lifestyle, both before and after reaching financial independence. It is a good option for individuals who prioritize a high standard of living and want the flexibility to enjoy their money while still working towards financial independence.

EXPAT FIRE

Expat FIRE just means pursing FIRE in another country besides your home country. One of the benefits of Expat Fire is that if you are from a nation with a high cost of living like in the US or Europe, then moving to a country with a lower cost of living means that you can reach Financial Independence much earlier or enjoy a much higher standard of living, while spending the same amount every month.

I’m currently living in Taiwan and I classify myself as somewhere in between LEAN FIRE and EXPAT FIRE:

After saving up $500,000 I‘m retiring early (or at least not ever working a “real” job again). My plan is to live off of the 4% Rule in Taiwan which will be about $20,000 USD/year or $1666/month.

Background: I’m currently 37 years old, from the US and have been living abroad for the past 10 years. Mostly in Taiwan but also bouncing around to other places in Asia (Thailand, Vietnam, Philippines, etc.).

I came to Taiwan first to teach English but then got involved in e-commerce and ran an online business for 7 years before selling it in early 2022. I currently have permanent residency here as well as National Health Insurance.

Monthly Expenses in USD:

Rent – $580.00

Bills – $65.00

National Health Insurance – $26.00

Cell Phone – $15.00

Food & Fun – $750.00

Misc. and Travel – $200.00/month (about $2,400/year)

The biggest challenge right now is dealing with the stock market being down. Luckily I didn’t get the final payout from the sale of the business until May 2022 so I have been able to put cash into the market as it’s been going down and still have more to put in if it continues to fall.

This experience has also taught me that a job or business is not something that just brings us money but also a sense of purpose. I worked hard to build a business and that was a big part of my identity for over 7 years. And although I don’t regret selling my business, I do miss having the clear direction and sense of purpose having a meaning job or business can give.

Which Type of FIRE Financial Independence is Right For You?

There isn’t a one size fits all approach to FIRE and you might find yourself in between two types or combining them into a hybrid FIRE approach.

No Matter what kind of FIRE you want to pursue, the key to success is to understand your own financial situation, set achievable goals and develop a plan that works for you.