WordPress and Cloudways

About 40% of the websites on the internet are built using WordPress. But what is the best WordPress Hosting? I’ve tried all the big hosts out there like GoDaddy, Host Gator, and Blue Host, and couldn’t be happier that I made the switch to Cloudways.

This is because Cloudways makes it easy to set up a WordPress website and their managed hosting is unbeatable. Their customer service team provides quick responses to any issues that may arise, and they make sure your site is always running smoothly. Plus, they offer a great range of features like free backups, multi-site support, custom email addresses, and a free trial.

So let’s dive right in and I’ll show you how to set up and install your WordPress site and Cloudways Hosting.

WordPress Website Basics

A WordPress Site consists of these four things:

- A Domain Name

- Hosting

- Content Management System (WordPress, Shopify, Etc.)

- Design

The domain name is also known as a URL and usually looks something like this: www.yourdomainname.com, this is the address where people can find your site.

Once you have your domain name, you need to “host” it on a server so that people around the world can access it. You can think about it as the plot of land where you will put your address.

Now that we have our domain name and hosting, we need to build our site with WordPress. Sticking with the housing analogy, WordPress is going to be our house.

After we install WordPress, we will design our theme (template) on WordPress.

Sign Up for CloudWays Hosting

Free 3-day trial – No Credit Card Required

Now that we have our domain name, we need to have it “hosted” on a server somewhere. There are a lot of different options but I have used a lot of them, GoDaddy, HostGator, BlueHost, etc. and they’re all extremely slow compared to Cloudways.

Cloudways is fast, has one-click WordPress install, free backups, a free SSL certificate, and is pay-as-you-go so you don’t even need a contract.

What sets Cloudways apart from other hosting is that it uses a VPS (Virtual Private Server) which is a virtual machine that provides virtualized server resources on a physical server that is shared with other users.

With VPS hosting, you get dedicated server space with a reserved amount of resources, offering greater control and customization than shared hosting.

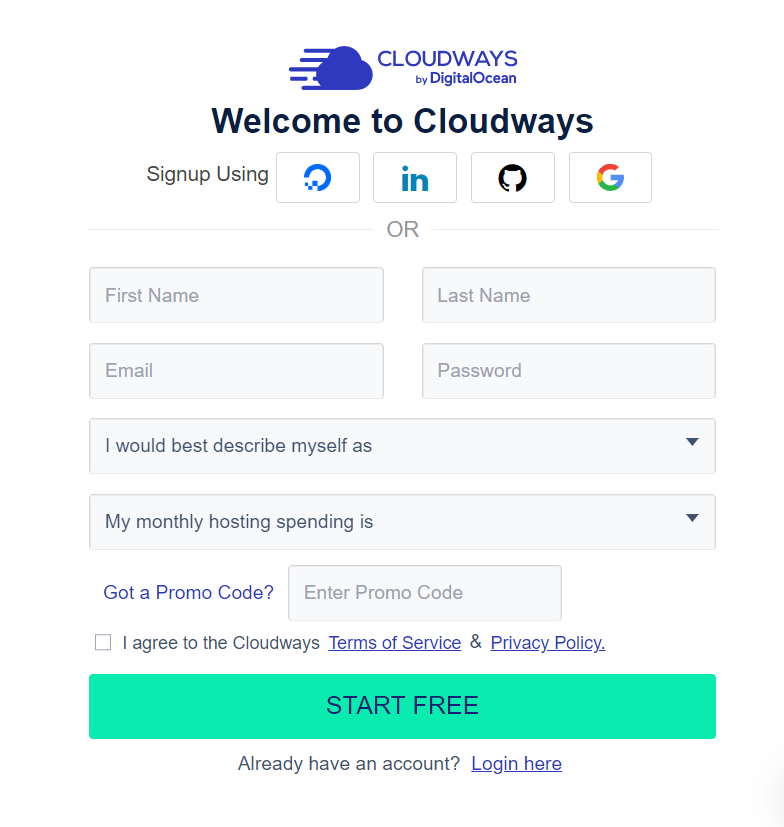

To get started with Cloudways, click Start Free (no Credit Card Required).

To Sign Up to Cloudways you just need to input some basic informaiton (no credit card required).

Cloudways Bonus Code

Use this bonus code: cloudways20 to save 20%!

How to Add a Cloudways Server

Once you’ve signed up for Cloudways, the next step is to add your server.

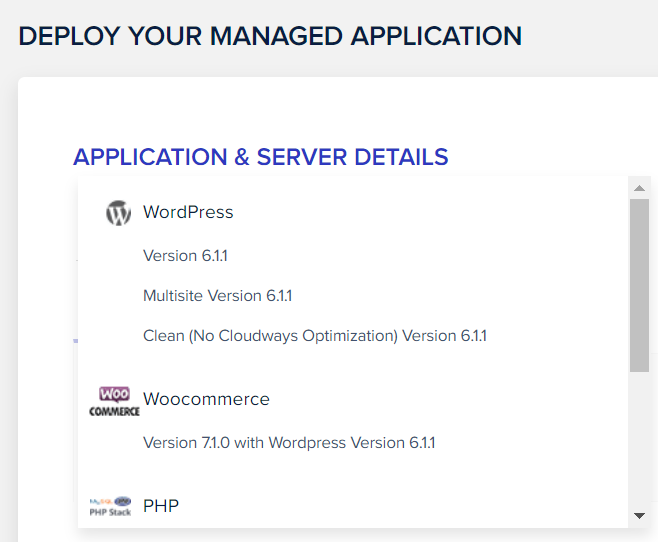

One-Click WordPress Install

First choose what version of WordPress you want to install. You can pick WordPress, Multi-Site or WooCommerce.

If you’re not sure which one to choose, select WordPress and you can add WooCommerce later or Multi-Site later..

Which Cloudways Server is Best?

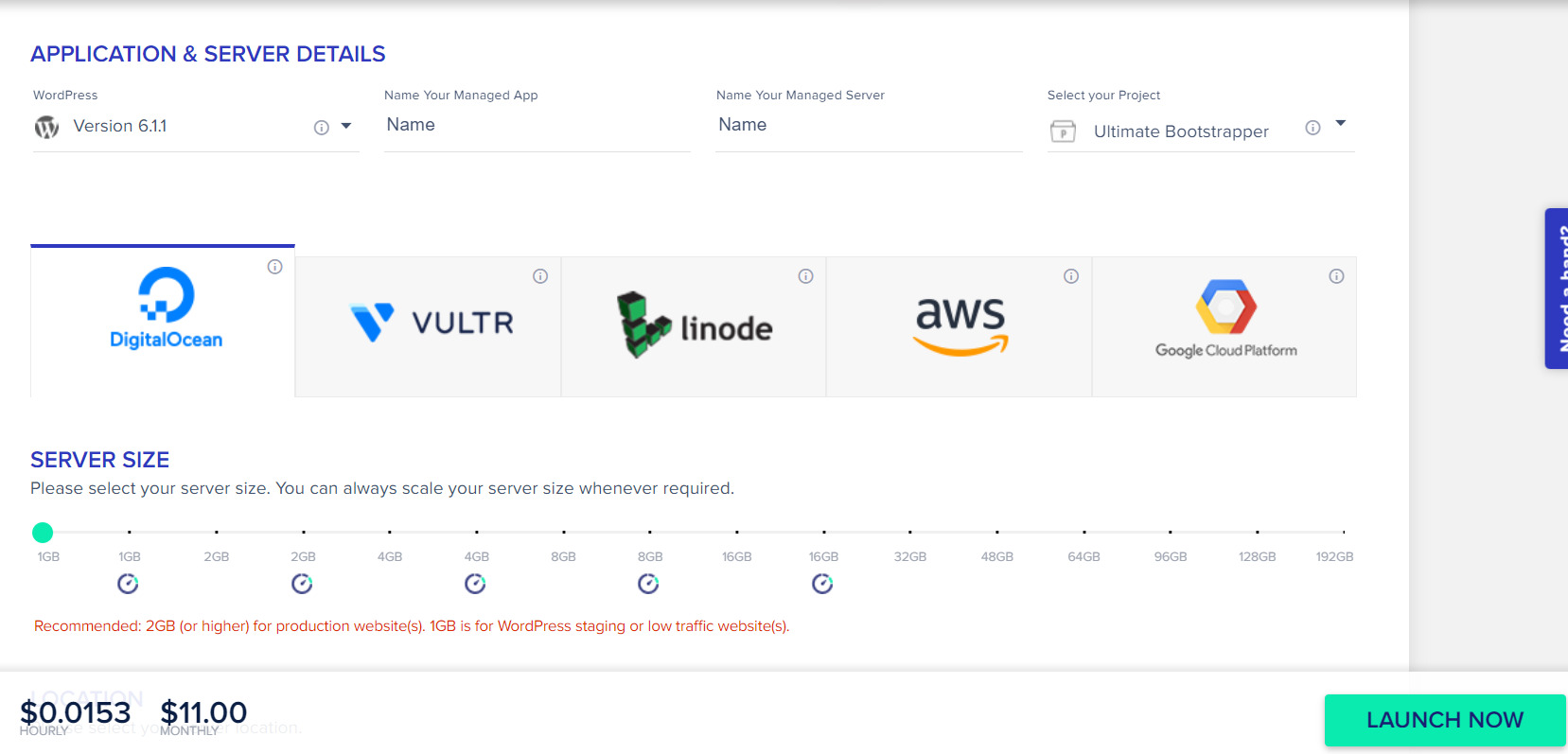

With Cloudways you can choose from several different servers:

Digital Ocean

Vultr

linode

AWS (Amazon Web Services)

Google Cloud Platform

I recommend using Digital Ocean Servers and choose the smallest option which is 1gb and if you need to add more you can always do that later.

This is the cheapest plan and is only about $11.00/month.

Save 20% with the coupon code: cloud20

Cloudways DNS Configuration

Now we want to “Point” our domain name from Namecheap to our server on Cloudways.

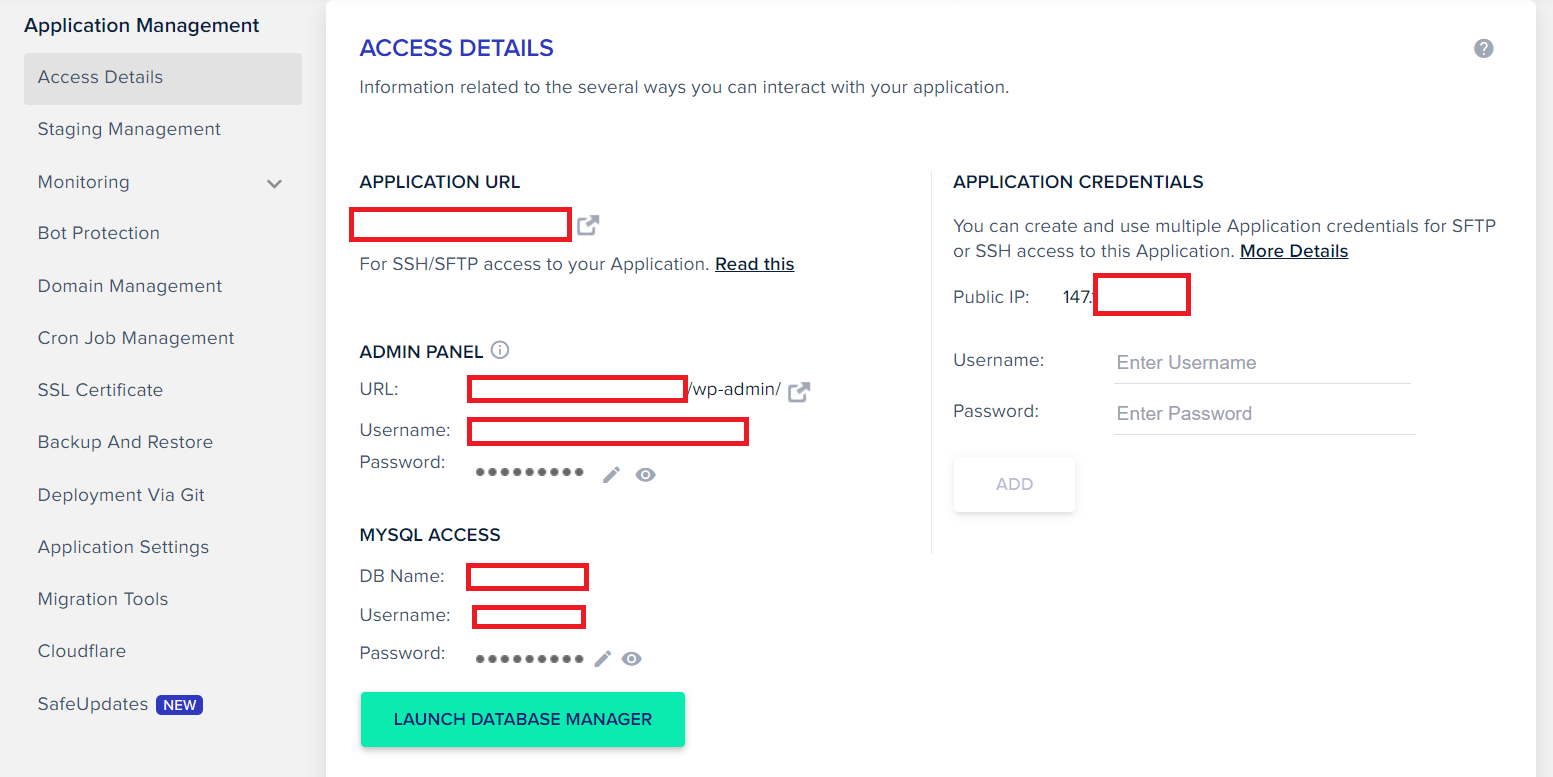

To do this, first go to “Access Details” in Cloudways – copy your IP Address:

147……….

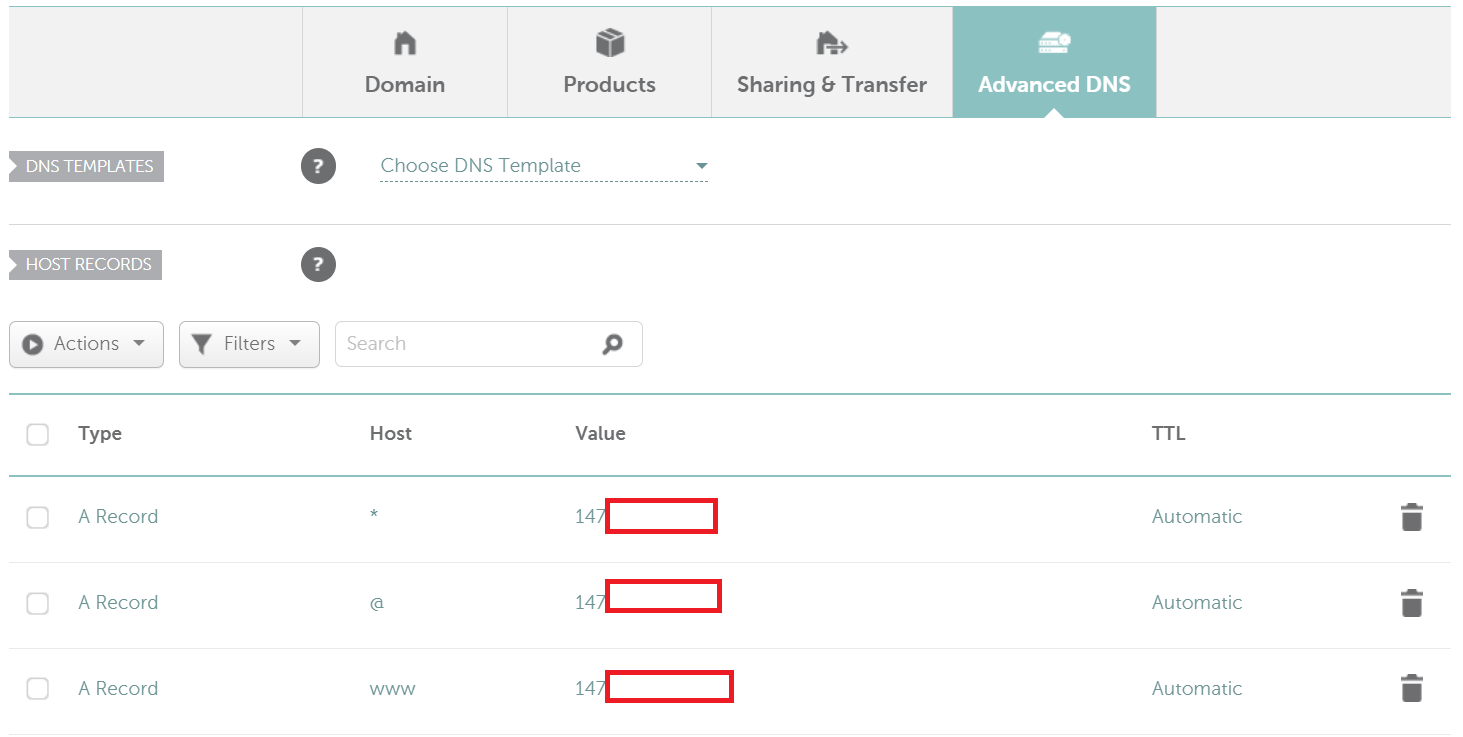

Namecheap Advanced DNS

Now it’s time to go back Namecheap:

- Click on your domain name

- Manage

- Advanced DNS

Add three “A Records” and put in your new IP address:

@ – used to point to a root domain yourdomainname.com to the IP address:

A Record | @ | 147……….

www – is selected when it is needed to point www.yourdomainname.com

to the IP address:

A Record | www | 147……….- a wildcard record that matches requests for non-existent subdomains:

A Record | * | 147……….

This usually only takes a few minutes but it can take up to 24 hours. Use whatsmydns to see the progress:

Cloudways Domain Management

Now go back to Cloudways and click on “Domain Management” – add your domain name (www.yourdomainname.com).

Set this as your primary domain.

Install SSL on Cloudways

Now we will install our FREE SSL Certificate.

Put in your domain name – www.yourdomainname.com

Make sure that auto-renew is on.

How to Test Your WordPress Site

Now it’s time to test our site. Type your domain name into your web browser. It should look like a basic WordPress theme. If it isn’t working yet, wait a few hours and check back later once all the servers have been updated.

How to Log In to Your WordPress Site For the First Time

Log into WordPress using the Access Details Information from Cloudways.

www.yourdomainname.com/wp-admin/

Picking a WordPress Theme

Now that you’ve setup your server, installed WordPress and pointed your domain name to it, you can now start building your website. If you’re feeling a bit overwhelmed by all of this don’t worry because Cloudways have a team of experts who specialize in helping people get their sites up and running quickly and easily. So if you

Free WordPress Themes

WordPress has a lot of Free Themes to get you started. We used Hestia in the video and it is a great Free Minimalist Theme. You can follow along in the Video to see how to set up Hestia.

Premium WordPress Themes

DIVI is my go-to Premium WordPress theme because of its out-of-the-box premium layouts, powerful drag-and-drop builder, unlimited design possibilities and it has an option for a lifetime payment instead of paying yearly like many other premium themes.

Adding Content to your WordPress Site

Once you have selected the theme, you can start adding content to your website. The most important pages are: About, Contact, Services and Blog. You can also add a portfolio page if you have projects or products to showcase.

Installing Plugins

There are thousands of free and premium plugins available in the WordPress repository that you can use to extend your websites’ functionality. It is important to keep your site secure by only installing trusted plugins and keeping them up-to-date with the latest versions.

Congratulations on creating a beautiful WordPress website with Cloudways hosting

WordPress Site with Cloudways Hosting Wrap Up

And that’s it! You now have a WordPress Website hosted on Cloudways. If you run into any issues or need help, the team at Cloudways is friendly and helpful and always more than happy to lend a helping hand. So don’t hesitate to reach out if you need help getting your site up and running.