P2P Investing | How to Make Money by Loaning Money

P2P Investing | How to Make Money by Loaning Money “Glenn, can I invest in loans, or loan money online with these new p2p lending websites?” My friend Ray asked me one day. “Or, do you need to be an accredited investor?” he continued. Ray, like many others, are lower...

How Instacart Works

How Instacart Works What is Instacart? Instacart is an on-demand delivery platform that connects deliverers with customers who want groceries delivered to their homes. Instacart was founded in 2012, and is available in most major U.S. cities. Apoorva Mehta is...

Find Freelance Work

How to Find Freelance Work Finding freelance work is by far one of the most challenging parts of being self-employed. A quick Google search will yield an almost endless list of results. As freelancers, we need all of the tools we can get when trying to find work...

Top 10 Tips for Uber Drivers

Top 10 Uber Tips for Drivers Uber is one of the most viral, controversial, amazing, innovative, and terrible companies of our generation. Well, it depends on who you speak to. If you ask us, and a lot of people do, we believe Uber is at the sharp end of the spear of...

How DoorDash Works

How DoorDash Works DoorDash is a delivery platform that connects customers with local businesses. Here is exactly how DoorDash works. As a DoorDash customer, you can order from your favorite local restaurant or store and “Dashers” – the independent contractors...

Budgets are Horseshit

Keeping a budget is one of the most common pieces of financial advice. But a budget might not be all it’s cracked up to be.

Airbnb Automation Tips for Hosts

Let’s face it, being an Airbnb Host today is harder than ever. Today we’re going to break the best Airbnb Automation Tips.

Meal Sharing for Foodies: Food Lovers Guide to the Sharing Economy

Meal Sharing for Foodies Disclaimer: The following is an excerpt from Chapter 4 of Part 2 of Secrets of the Sharing Economy, available at Amazon. “The only thing I like better than talking about Food is eating” – John Walters “Food is something holy. It’s not about...

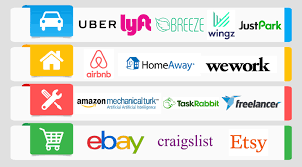

What is the Sharing Economy?

What is the Sharing Economy? I try not to engage with belligerents on Twitter, but I had to respond to Mr. B’s comment: “Glenn, clearly you missed the truth about apploitation. The sharing economy isn’t sharing, it’s skirting labor laws and human rights.” *Glenn...

How to Cash in and Kill it on Taskrabbit

How to Cash in and Kill it on Taskrabbit Gig economy tasking services like TaskRabbit, AskForTask, and AirTasker, pay people to complete the to-do lists of others. This can be anything from assembling furniture, hanging a painting, yard work, cleaning, painting a bed...

Can You Drive for Uber without a Car?

Driving for Uber without Owning a Car Have you ever dismissed the Uber or Lyft option because you have no vehicle? Or because your vehicle does not meet their criteria? All hope is not lost. This post is for you. Or for anyone else looking to start fresh in the...

How to Make Money Delivering Part Time

How to Make Extra Money Delivering Part Time There are a ton of differerent delivery platforms in the sharing economy and gig workers are cashing in on some of the profits. Today we are going to talk about how to make money delivering goods. The delivery market in...

Platform Stacking How to Multiply Your Sharing Economy Salary

Are you a sharing economy pro, already earning big bucks through platforms like Uber, Airbnb, or TaskRabbit?

Awesome start, but why stop there?

Top 10 Gig Economy Platforms

The Gig Economy has exploded in recent years where anyone with an internet connection can start earning money as a freelancer. But what are the best platforms for gig economy workers?