I’ve been living on the four percent rule for the past year and in this article I’m going to talk about how realistic it is, how much you need to save before you can start living off the 4% rule as well as some of the benefits and challenges I’ve faced over the past year.

Is Living off the Four Percent Rule Realistic?

The 4% Rule is just basic math that relies on historical assumptions. In a nut shell, it states that if you invest in a stock and bond portfolio that you be able to withdraw 4% of the total principle each year and never run out of money.

I personally have 70% allocated in an S&P 500 Index Fund (SCHX), 1% in Bitcoin/Etherium, about 24% to a money market fund that currently earns over 5% (SWVXX) and the rest in cash in various bank accounts. When the market goes up I sell some of my S&P 500 Index Fund and when it goes down I buy more so my allocation to stocks fluctuates from 60% to 80% depending on market conditions.

This has allowed me to realize some tax free long term capital gains and gives me a sense of control over something which I basically have zero control of.

The Results:

As of writing this in late November 2023, my portfolio is up about 3% from when I started which is basically where it is “supposed” to be. The 3% increase accounts for inflation which historically has been around 3%.

If I would have written this a month ago on October 27th, 2023 then my portfolio would have been down about 3% instead of being up 3%. The point being, that living on the 4% rule is a long term plan that requires a long term outlook. In any given day, month or year the market (and your portfolio) could be up or down dramatically and to follow the four percent rule, you need to have patience and rely on the historical assumptions of the past 100 years or so.

How Much Do You Need to Save to Live on the 4% Rule?

This is a highly debated and personal question that will completely depend on your flexibility and expenses. If you have a mortgage, spouse and kids then you will absolutely need to have a much higher starting balance to withdraw from than if you are single and able to move around to cities and countries with a lower cost of living.

You might be able to save up $300,000 and live in Chiang Mai off of $1,000 a month the rest of your live but would you really want to? I suspect that this would get old pretty fast and eventually boredom will set in.

I basically lived off the 4% Rule for a year with $500,000 after selling my business. The first couple months of relaxing and reflecting were great but it quickly dawned on me that I don’t want to do nothing for the rest of my life and that $500,000 isn’t nearly what it used to be. Combine this with a stock market that hasn’t reached an all-time high in almost two years, high inflation, high interest rates and multiple regional conflicts I decided that it was time to modify my plans and have decided to switch to more of a BaristaFIRE or CoastFIRE approach. Basically earning some extra money to either subsidize or completely cover my expenses.

So far the benefits of this are huge because it not only gives me some extra cash for added security but also a sense of direction, structure and purpose that I lost when I sold my business.

Benefits and Challenges of Living on the 4% Rule

Time and Freedom:

The biggest benefits are time and freedom. If you have your expenses matched with your withdrawal rate then you can just sit back and relax when you want to.

Time and freedom are also a double edged sword though and if you’re not careful, this can quickly turn into boredom and despair.

Passive Income:

The 4% Rule is predicated on living off of passive income. The simplest form is investing in index funds and over the long-run, broad market index funds have had an amazing track record with an average return of about 10%. The key word here being “long-run” and if you focus on the day to day volatility then you will undoubtedly take your emotions on a roller coaster ride.

Passive Income, by definition, means that you are not involved in it. This is great if it’s working out and everything is going up, but if it’s not, then you have to come to terms with having no control over what happens.

4% Rule Dividends:

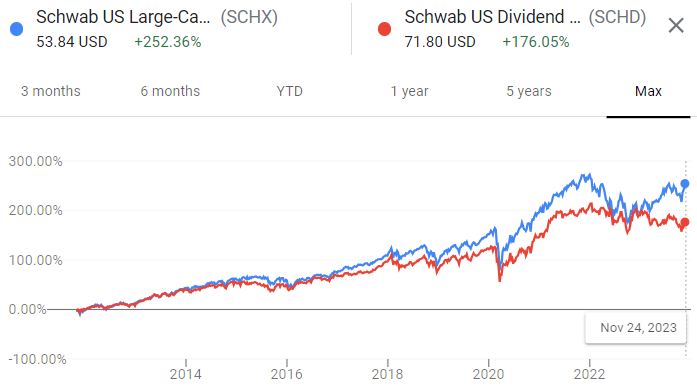

Dividends are another hotly debated topic among Four Percenters and the FIRE community with some preferring to live solely off of dividend income instead of withdrawing 4% from their portfolio. I’ve always been more of a fan of the S&P 500 than dividend ETFs like SCHD because of the historical track record. But, as dividend fund advocates are quick to point out, up until about a year ago, SCHD out preformed the S&P 500 while also dispersing a larger dividend.

However in 2023 this trend reversed back to the historical mean and the S&P 500 is now looking like the better bet.

Whether you choose broad market index funds or dividend funds, in most cases, you will still receive a dividend. The dividend for the S&P 500 is usually about 1.5% and you should also be earning dividends or interest from your cash.

The Big Picture

From my experience it’s been important to not draw hard and fast rules with the 4 percent rule. It’s a guideline that can help direct you towards your retirement and life goals but will need adjusting from time to time and remaining flexible and liquid is extremely important.

For example, the interest rate that bonds, cash or whatever you’re not investing in stocks can vary dramatically. Over the past year my money market fund (SWVXX) has yielded about 5%. But the 5 year average is only 1.6% and the 10 year average is 1.1%!

These differences can have a profound effect on your overall portfolio performance and at sometimes it will make more sense to have more of your portfolio in “cash” and at other times it will be more advantageous to allocate more in stocks.

The key is to remain flexible, open minded and nimble and realize that most assets will return to their historical averages. Also that sometimes the conservative approach is the most risky (just ask Silicon Valley Bank) if you aren’t diversified and liquid enough to change with the times.