If the 4% Rule Means saving up a chunk of money, withdrawing 4% a year and then sailing off into the sunset, what does the reverse 4% Rule Mean?

It’s basically just the inverse of the 4% Rule and is somtimes called the 25x Rule for Retirement.

Reverse 4 Percent Rule

With the 4 Percent Rule, someone generally looks at how much they can save over a given time period and then they try to live off of a 4% withdrawal rate. 4 percent is sometimes called the safe withdrawal rate because under most circumstances, you can take out 4% of a retirement portfolio and not run out of money. This was made famous by the Trinity Study.

Since we are going to be reversing this rule the instead of multiplying our nest egg by .04 to get our expenses. We’re going to start with our expenses and multiply them by 25.

25 x 4% = 100%

The Flaws in the Reverse 4% Rule

Inflation impact on fixed withdrawal rates

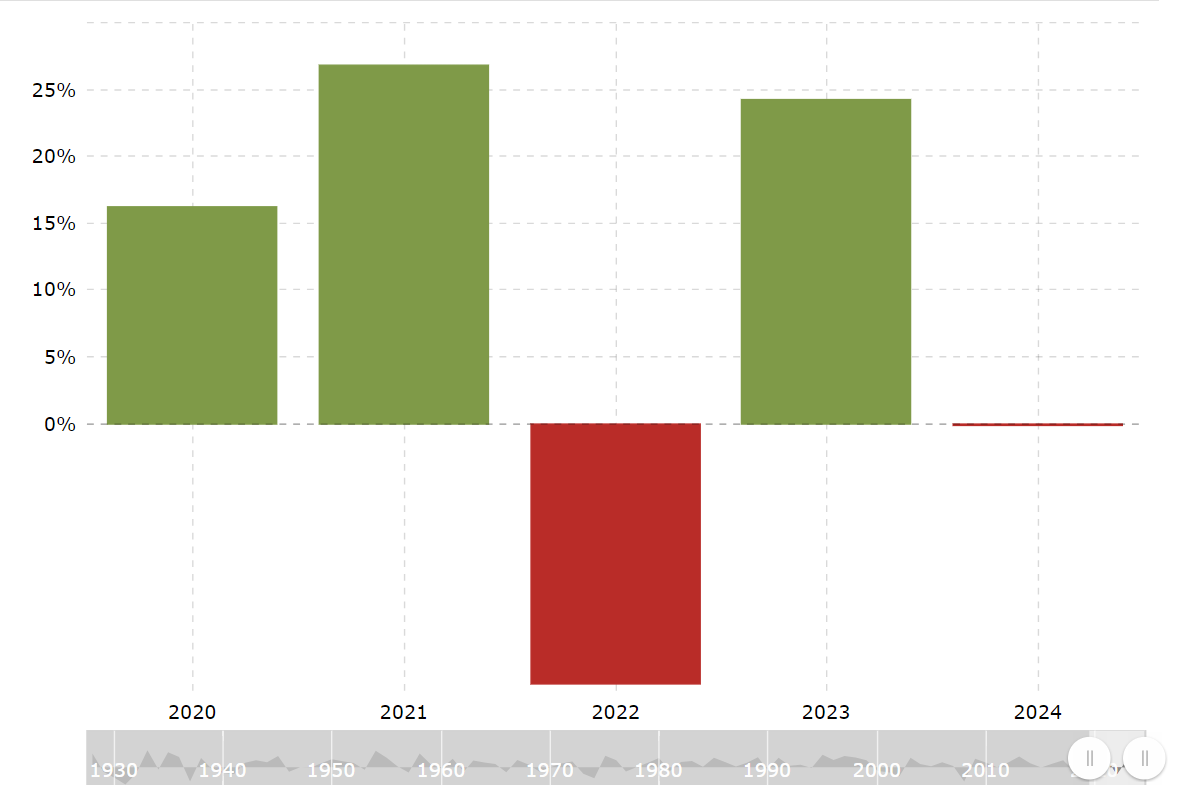

Inflation over the past 50 or so years has averaged about 3% and the reverse 4 percent rule takes this into account. But as we have all seen in 2022, inflation can fluctuate a lot and in a hurry!

One of the primary concerns with the conventional 4% rule is its vulnerability to inflation. As prices rise over time, a fixed withdrawal rate may not sustain the desired lifestyle for retirees.

Market volatility and its effect on sustainable withdrawals

The 4 percent rule takes into account a 7% increase in your portfolio every year. But market fluctuations pose another challenge to the Reverse 4% rule.

A sudden downturn can significantly impact the portfolio’s value, forcing retirees to either reduce their withdrawals or risk depleting their savings prematurely.

2022 is another prime example of this where the S&P 500 went down almost 20%! But as long as you didn’t sell at the low, it rebounded in 2023 and was up about 24% for the year.

4% Rule vs Reverse 4% Rule

Reverse 4% Rule Example:

$1,000,000 x 4% = $40,000

$40,000 x 25 = $1,000,000

Understanding the Reverse 4% Rule

Definition and concept

The reverse 4% rule flips the traditional approach by adjusting withdrawal rates based on market conditions and economic factors. Rather than sticking to a fixed percentage, this strategy advocates for flexibility in response to financial changes.

How it differs from the traditional approach

While the conventional 4% rule provides a sense of stability, the reverse approach acknowledges the dynamic nature of financial markets and tailors withdrawals accordingly.

Factors Influencing the Reverse 4% Rule

Economic conditions

The state of the economy plays a pivotal role in determining withdrawal rates. A robust economy may allow for higher withdrawals, while a downturn might necessitate more conservative financial choices.

Lifestyle and spending habits

Individual preferences and spending habits are crucial considerations. The reverse 4% rule encourages retirees to align their withdrawals with their chosen lifestyle, promoting a more personalized approach.

Strategies to Implement the Reverse 4% Rule

Diversification of investments

A well-diversified portfolio can mitigate risks and provide a buffer against market uncertainties. Allocating assets strategically is key to optimizing the benefits of the reverse 4% rule.

Adjusting withdrawal rates based on market performance

Regularly assessing the market and adjusting withdrawal rates accordingly ensures adaptability. This strategy allows retirees to capitalize on favorable conditions and minimize the impact of market downturns.

Criticisms and Controversies

Debates within the financial planning community

The reverse 4% rule isn’t without its skeptics. Some financial experts argue that the traditional 4% rule provides a more straightforward and reliable framework for retirement planning.

Alternative perspectives on retirement planning

Exploring alternative viewpoints sheds light on the diversity of opinions within the financial community. Different experts may advocate for varying strategies, adding complexity to the decision-making process.

Steps to Calculate Your Reverse 4% Rule

Assessing retirement needs

Calculating retirement needs involves a comprehensive evaluation of living expenses, healthcare costs, and other financial obligations. This step sets the foundation for determining an individualized withdrawal strategy.

Considering life expectancy and health factors

Adjusting the reverse 4% rule to account for life expectancy and potential healthcare expenses ensures a more accurate and realistic approach to retirement planning.

Common Mistakes to Avoid

Underestimating healthcare costs

Healthcare expenses are a significant factor in retirement planning. Underestimating these costs can lead to financial strain later in life.

Neglecting emergency funds

Having a robust emergency fund is vital. Neglecting this aspect can leave retirees vulnerable to unexpected expenses, undermining the effectiveness of the reverse 4% rule.

Pros and Cons of the Reverse 4% Rule

Advantages in certain market conditions

The flexibility of the reverse 4% rule shines in favorable market conditions, allowing retirees to capitalize on growth and maximize their withdrawals.

Risks and challenges associated with the approach

Market downturns and economic uncertainties present challenges. It’s crucial for retirees to weigh these risks against the potential benefits before adopting this strategy.

Planning for Unforeseen Circumstances

How to adapt the strategy to unexpected financial challenges

Flexibility is a cornerstone of the reverse 4% rule. Understanding how to adapt the strategy to unforeseen circumstances ensures its resilience in the face of unexpected challenges.

The role of flexibility in retirement planning

Being adaptable in financial planning is essential. Flexibility allows retirees to navigate changing circumstances without compromising their long-term financial security.

My Personal Experience with the 4% Rule

My portfolio is made up of about 70% Stocks (S&P 500 Index Fund) and 30% Cash.

I keep the 70% stock part very simple and only use one ETF, Schwab’s SCHX. This has the top 750 US companies in it so it is more diversified than the S&P 500 and produces almost idential results.

For those who say Cash is Trash, I will defend my position by saying that the vast majority of this cash is in a Money Market Fund that is making over 5% as of January 2024. I do expect this to fluctuate as interest rates decrease

Not only is the Money Market Fund extremely Liquid, it also gives me an enormous amount of flexibility for other investments or for buying the dip in the S&P 500.

Portfolio Performance

I’ve been living off of the 4% Rule for almost 2 years and my portfolio is currently up over 6%. This means that I have spent 4% each year and still increased my networth by about 3% a year. This is exactly what the 4% Rule is “supposed” to do over the long run and I have confidence that it will continue to do this over a long enough period of time.

Final Thoughts

The future is unknown and the market could drop by 30% but instead of fearing this potential drop, I have positioned myself to take advantage of it by buying the dip with cash reserves and trying not to stress out about it too much. Being in the stock market is a long term plan a day to day or year to year fluctuations are normal and should be expected.